Many banks are changing their services to help people who are vulnerable or extremely vulnerable to coronavirus, or in self-isolation.

Ensuring digital banking services are accessible is now even more vital for supporting people remotely during the pandemic.

In the current pandemic, many disabled people are in the highest risk category. Which means they will be shielding or self-isolating for much longer than the rest of the population.

More disabled people are now relying on digital banking services to manage their finances than ever before. For many disabled people, visiting a physical bank branch is no longer possible.

To see what kind of support your bank is offering, use the skip links in the table of contents.

Accessible support during coronavirus

While most banks have invested in their digital services in recent years, accessible banking is still an issue for some.

Banks that already supported their disabled customers with accessible services have adjusted more easily to these changes. Barclays and NatWest are good examples.

Many banks have published coronavirus blogs and Frequently Asked Questions pages, directing customers to the services they may need. Most banks we reviewed offer Textphone and BSL video interpreting services to support disabled customers banking online. Many of these services rely on helplines though, and currently waiting times are longer than usual.

Online and app-only banks like First Direct, Monzo and Starling Bank lead the way in customer service polls. But support for disabled customers is limited compared to high street banks.

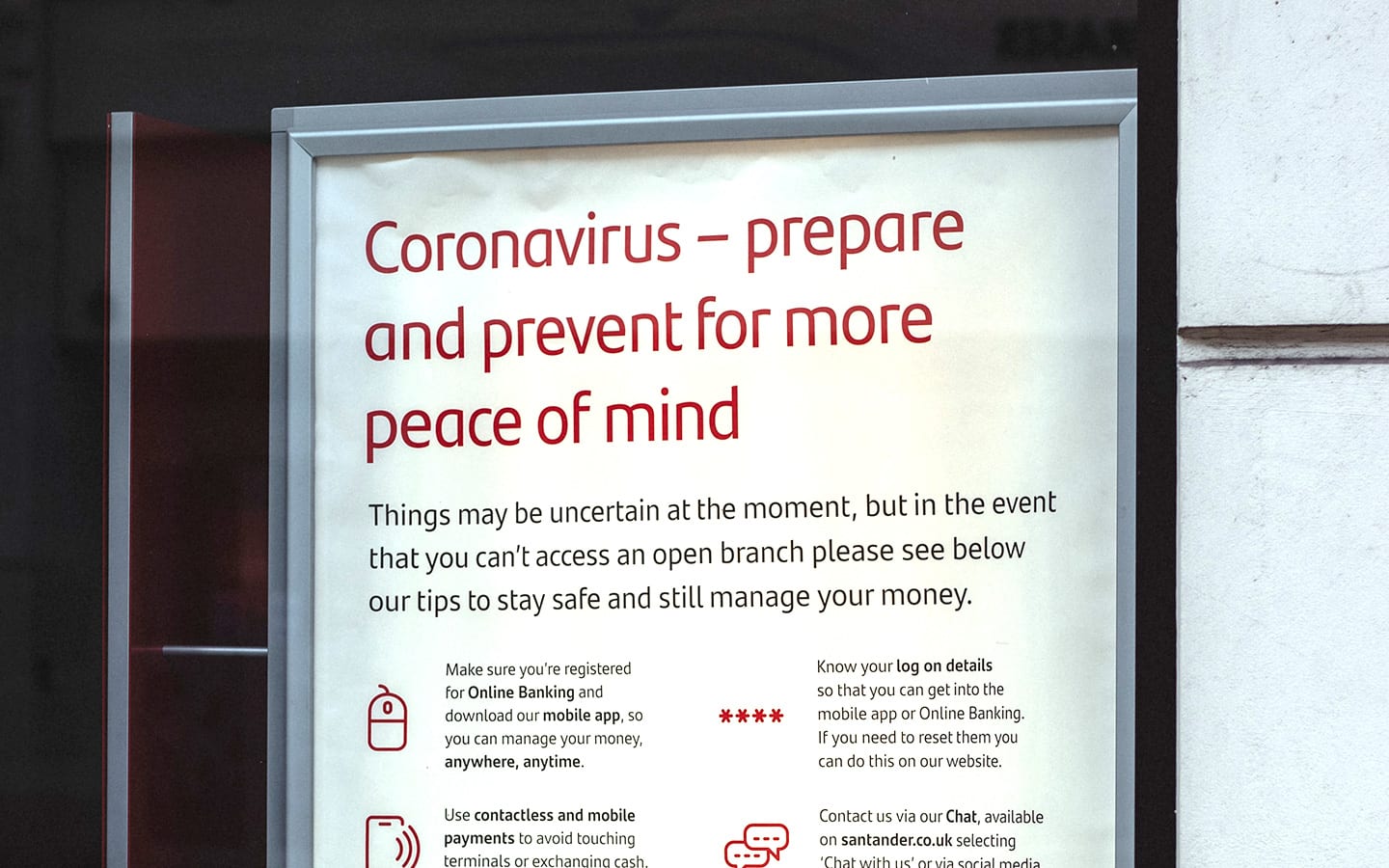

Most banks are offering similar advice and basic levels of support for customers during this time.

These include:

- Reduced bank branch opening hours

- Asking customers to use online or mobile banking apps

- Dedicated web pages and blogs with tips and advice

- Increasing individual contactless purchases up to £45 to reduce contact with pin pads

- Flexibility around loan, mortgage and credit card repayments

- Freezing interest on overdrafts or extending overdraft limits

We look at how individual banks are supporting disabled people who are self-isolating during this crisis.

How banks are supporting disabled customers

Barclays

Barclays is an accessibility industry leader, developing many award-winning services for disabled people. They were the first bank to provide talking cash machines for visually impaired customers in 2012, with more than 80% now having this feature.

They are also the only bank with a Twitter account dedicated to accessibility, disability and mental health. This account lets them have conversations with the disabled community to help improve their services. The bank has focused on making its services in branches accessible for everyone. And they are the only bank to offer online BSL interpreters for branch visits.

Services available to disabled customers who are self-isolating

The remote services that Barclays has developed for disabled customers are useful for those self-isolating, particularly those with hearing impairments. However, many of these remote services ask customers to use a helpline, with longer waiting times due to reduced staff numbers.

Online and mobile banking

Barclays mobile app has been awarded the AbilityNet Accessibility kite mark by the charity AbilityNet. This means the app has high accessibility standards and is compatible with features like voiceover technology.

Both the Barclays website and mobile banking app have a secure live chat feature. Their mobile app allows customers to make payments and transfer money securely to someone else’s account. You can also pay in cheques using the app.

The Barclays’ website also has clear step-by-step guides to help you manage your money online.

Accessible PINsentry card reader

Barclays audio PINsentry card reader is a more accessible version of a typical card reader.

It helps people with visual impairments log in to online banking and manage their account. It’s larger than a standard card reader, with a bigger screen and an ergonomic keypad.

Next Generation Text Relay

Customers with Textphone can speak to a Barclays advisor with the help of an operator. The operator speaks on the customer’s behalf, using the text they are typing.

SignVideo service

This service connects you to an interpreter who can communicate sign language to the Barclays adviser. You can call any Barclays helpline number using British Sign Language (BSL).

It’s available from 8am to 8pm Monday to Friday, and 8am to 1pm on Saturdays (excluding bank holidays).

Register for online banking with Barclays

Find out more about the Barclays app

How To videos for online and mobile banking with Barclays

Register for a PINsentry card reader

HSBC

HSBC has been making sure branches and ATMs are accessible for everyone. In the past two years they have updated their website and digital services to meet accessibility standards. As part of these updates, HSBC has upgraded its live chat function for those with sight loss. The bank is also making it easier for deaf customers to manage their accounts with video services and text relay options.

You can register for mobile and online banking through the website. The website has simple step by step guidelines for setting up online banking.

HSBC is asking customers to use online or mobile banking, and to only call if it is urgent so they can help those who most need it.

British Sign Language Video Relay Service

HSBC’s BSL video interpreting service connects the user with a qualified BSL interpreter and HSBC telephone banking advisor. The service is available from 8am to 6pm, Monday to Friday. All you need is a computer, tablet or mobile, a camera and an internet connection.

Textphone service

The HSBC textphone service allows people to speak to a customer advisor, without needing a third-party translator. You can access a range of services and support with their textphone service.

Next Generation Text Relay

Customers who are unable to hear or speak on the phone can use HSBC’s Next Generation Text Relay service. A few banks use this service. Customers are connected with a text relay operator, the operator speaks the customers typed words to the assistant on the other end, and relay what the bank assistant is saying back to the customer through text.

Website Live Chat

HSBC’s website live chat function uses technology approved by W3C so people with visual impairments are able to use the service.

Lloyds

Lloyds is another bank to partner with AbilityNet to improve the accessibility of their digital services. In 2019, they became the first UK organisation to offer BSL translation on their website using the Chrome extension Signly.

Lloyds was given the Autism Friendly award, after committing to becoming the UK’s first autism-friendly bank. Their website details how they are making banking easier for other disabilities as well. Some of these will continue to be useful during the current coronavirus crisis.

Services available to disabled customers who are self-isolating

Lloyd’s are encouraging customers to use their mobile banking app or online banking instead of visiting a branch. The website has step by step guides on how to install the app or register for online banking, as well as a web chat function.

Phone lines are open, but Lloyds is asking that people only call if it is urgent so they can keep the lines free for their most vulnerable customers.

Signly Google Chrome extension

This free service allows deaf and hearing-impaired customers to watch videos on the Lloyds website with BSL translation. The videos are pre-recorded and signed by qualified sign language translators. All you need to do is add the extension to the Chrome or Mozilla web browser.

Textphone service

For customers with a Textphone, Lloyds has specific numbers to call for help with their services.

SignVideo interpreting service

Lloyd’s SignVideo interpreting service allows deaf, hearing-impaired and deafblind customers to speak to Lloyds through a qualified BSL interpreter. The service is open from 9am to 5pm Monday to Friday. You’ll need a computer with a camera and internet access.

Digital skills academy

Lloyd’s digital skills academy aims to boost customers’ digital knowledge and feel more confident banking online. Online courses cover topics like internet security, managing social media and how to use video calling software.

Mental health and financial wellbeing support

Lloyds is directing customers to Mental Health UK, for tips and ideas to help people look after their mental health during this time.

They have set up a page dedicated to mental and financial wellbeing during this time.

Lloyds’ Signly browser extension for BSL translation

Nationwide

Nationwide are keen to make sure their services are accessible and easy to use for everyone. Like many high street banks, they have implemented a range of measures in their branches to improve accessibility.

They state on their website that they have recently reviewed their digital banking services and are working to address any issues. They encourage customers to get in touch with any feedback.

Beside online and mobile banking, they have a couple of services that are supporting disabled customers in the pandemic. These services generally cater to deaf and hearing-impaired customers, but not always others.

SignVideo

If you are deaf or have a hearing impairment, you can contact Nationwide through a BSL interpreter using SignVideo. This service is available between 8am and 6pm, from Monday to Friday.

Text relay

You can contact Nationwide’s telephone banking service using Text Relay or a text phone. Their telephone lines are open between 8am and 8pm, 7 days a week.

Accessible services at Nationwide

Nationwide’s commitment to digital accessibility

Halifax

As a subsidiary bank of the Lloyds Banking Group, we expected Halifax to have similar offerings to Lloyds. While Halifax offers support for disabled customers in their branches, they have fewer accessible digital services.

Services available to disabled customers who are self-isolating

Halifax have asked customers to use mobile or online banking instead of visiting a branch. The Halifax website has step by step guides on how to install the app and register for online banking. Their website is compatible with screen readers and also has a live chat function. Customers with hearing or speech impairments are able to contact the bank on any of their phone numbers by Textphone.

They are prioritising vulnerable customers on their phone lines, but customers must let Halifax know that they need additional support ahead of their call. It isn’t clear how customers can do this though.

NatWest

NatWest has invested in its online accessibility in recent years. Perhaps because they have closed the most branches out of any UK bank.

They launched an RNIB accredited mobile app and are the only bank to launch accessible debit cards with tactile markings or large print.

NatWest has a range of remote services to help customers during lockdown. And they have set up a dedicated phone line for those self-isolating.

Services available to disabled customers who are self-isolating

NatWest is encouraging customers to use their app to manage their finances. You can also use the mobile app to pay a family member or friend who is buying your groceries, using only their mobile number.

For other online banking needs, you can log into their online banking website or app. Both the app and website are supported by a live chat function.

Digital tutorials and lessons

Not every customer in extended isolation may be comfortable managing their finances online or through an app. NatWest has created a dedicated page to support them. It includes tips and tutorials videos for the mobile app and online banking. Including free tutorials to help you get more confident with digital banking.

They also have useful videos to help you make the most of the mobile app’s accessibility features.

Companion card

NatWest is offering a connected shopping card for customers who are isolating and unable to order shopping online. This service allows you to get an extra debit card that you can give to someone you trust. They will be able to make purchases and withdraw cash on your behalf. You can call the vulnerable customers helpline to register for one.

Video banking

Natwest’s video banking service lets you talk to a customer service operator through a Zoom videoconference. All you need is a smartphone, tablet or computer with a camera and internet access.

Once registered, you receive an email that shows you how to download the Zoom app ahead of the call. The service runs from 8am to 8pm from Monday to Friday and 9am to 3pm on Saturday.

SignVideo with BSL

Allows British Sign Language users access to telephone banking using a BSL interpreter using SignVideo. The service is available from Monday to Friday, 8am to 6pm.

Minicom and TextRelay

All Natwest’s telephone services have a minicom number to help customers connect using TextRelay.

Vulnerable customers helpline

Natwest’s customer care experts are available seven days a week from 8am to 8pm. They can guide you through the steps to register for online and mobile banking.

This service has been set up for customers over 70 and for those required to shield for 12 weeks. Customers with hearing loss can use the service using the Relay UK app.

Accessible services at NatWest

Banking support from NatWest during coronavirus

How to videos for mobile banking with NatWest

First Direct

Telephone and online-only bank First Direct is regularly voted at the top of customer service polls. The bank is known for its 24-hours a day, 365-days-a-year telephone banking service. It does not have any physical branches.

However, First Direct offers little in the way of extra digital services for disabled customers. Their support for people currently self-isolating is also limited. While online and mobile banking is available, you need to pay cheques in at an HSBC branch or by post.

The RNIB found that the First Direct app is inaccessible because it cannot be used with either TalkBack or VoiceOver. This includes both Apple and Android apps.

Sign Video

Customers who are deaf or hearing-impaired can connect to a BSL interpreter using the Sign Relay service, which uses SignVideo.

First Direct’s telephone banking service is available 24 hours a day, everyday. But customers can only access SignVideo between 8am to 6pm from Monday to Friday. Unfortunately, this means that deaf and hearing-impaired customers cannot take full advantage of the service that makes First Direct so unique.

Video Relay Services at First Direct

Royal Bank of Scotland (RBS)

RBS and NatWest are part of the same banking group. As a result, their accessibility and support services are similar. They have a dedicated page for customers who are self-isolating. With digital tutorials, video banking and guides to getting started with the app.

Customers can also apply for a Companion Card. This allows a friend or family member to pay for shopping for you. You can also have cash delivered to your home.

RBS has a vulnerable customers helpline, open from 8am to 8pm every day. They also offer SignVideo and Text Relay support for telephone banking.

RBS support page for vulnerable customers

Monzo

Monzo was one of the earliest online banks to launch in the UK. But like other mobile banks, Monzo is limited in what it can offer customers during this time.

They do not have any specific services for disabled customers during the current crisis. If you want to talk over the phone, you can visit the help section in the app and arrange a call. You still need to pay in cheques in the post.

Monzo was recently criticised for freezing hundreds of customer accounts during lockdown.

How Monzo is supporting customers during coronavirus

Starling Bank

Customers access their banking services through the bank’s mobile app. Some customers have complained about the app’s lack of accessibility.

Starling is telling its disabled customers to get in touch if they need extra support accessing their account. Starling Bank is offering a wide range of support for customers during the coronavirus pandemic.

They have responded to the current situation by releasing new products and services to support people who are self-isolating.

Starling Connected Card

Starling has introduced a connected shopping card for people who are self-isolating and relying on friends, family and community volunteers to buy their shopping for them.

Personal account customers can request a second debit card connected to their account using the Starling app. You can hand this second card to someone you trust, who will be able to spend a limited amount of money securely in store. Without having to exchange cash or share bank details.

Pay in cheques through the mobile app

Helpful for those who can’t get to the post office, Starling Bank’s new feature on the app allows customers to deposit cheques up to £500. Customers just need to take a photo of the cheque on their phone and upload it within the app.

Find out more about paying in cheques using the Starling Bank app.

A dedicated blog

Similar to other banks, Starling have a dedicated coronavirus section on their blog. As well as sharing information and financial explainers, it also offers tips to help customers during this time.

How to pay in cheques from your mobile phone

More resources

Scope Coronavirus information and updates

How to get support from your bank (UK Finance)

How is your bank helping customers in the coronavirus pandemic (Moneyfacts)

Have you had an experience with digital banking and accessibility? Let us know in the comments.